As promised Filing taxes on a post card from now on, or are we? IRS has released a 2018 DRAFT 1040 Tax return that would fit on a post card. The new smaller size 1040, is intended to replace the old 1040, 1040A and 1040EZ.

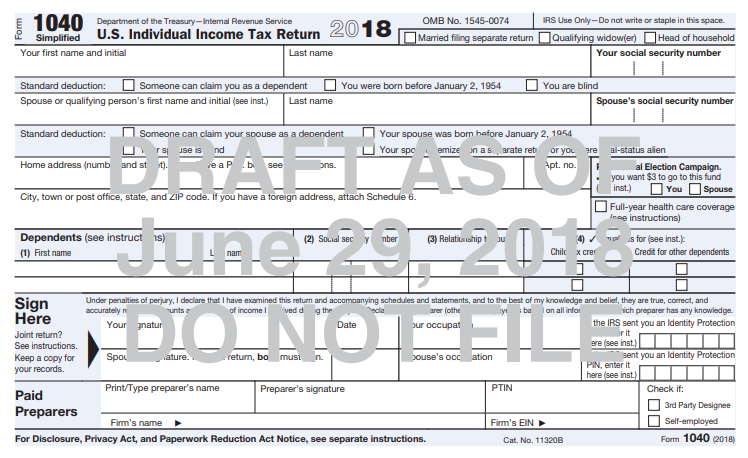

DRAFT 1040 Pg. 1

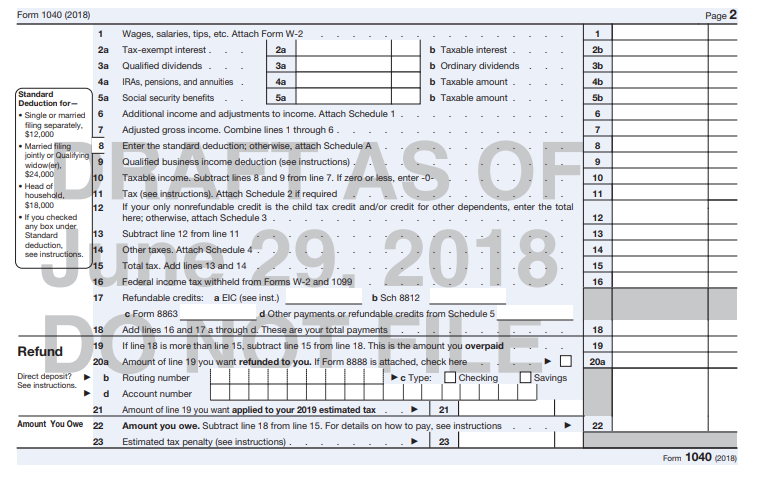

DRAFT 1040 Pg. 2

Do note that “this is an early release draft of the 2018 IRS Form 1040, U.S. Individual

Income Tax Return, which the IRS is providing for your information, … Do not file draft forms. Also, do not rely on draft forms, instructions, and publications for filing.”

The form has shrank quite a bit.

Was that much really eliminated during the tax reform?

Well, of course not.

So where did it all go?

IRS has also released 6 DRAFT Schedules to the new postcard-size 1040. See links to the DRAFT 1040 and schedules bellow.

But most people will be able to file with out the schedules right?

NO, ……. at least a few of the schedules will be required for most tax filers.

So who would need a schedule attached to their 1040?

Any one with additional income and adjustments to their income. For example: Business income, Capital gains (losses), Rentals, Royalties, Passthough Income, student loan deductions, SE tax, Moving expenses, Health Savings account deductions, IRA deduction are just a few among many others.

Also, anyone to whom AMT or NIIT tax applies, or those with non refundable credits like Foreign tax credit, credit for child and dependent care expenses, Child tax credit and credit for other dependents among others.

Also, anyone who makes estimated tax payments, or payments with request for extension will be required to add an additional schedule.

Also, anyone with a foreign address and third party designee will be required to add an additional schedule.

So we went from the 1040 being 2 pages to 8 pages. Thank you! for making filing our taxes easier.

There is a 30-day comment period for this draft form. So there is no better time than now to voice your thought and concerns.

If you wish, you can submit comments about this draft Form 1040 to WI.1040.Comments@IRS.gov.

For More Information See:

The materials posted in this article are for informational purposes only and should not be regarded as accounting or tax advice provided by YR Tax Compliance LLC. These materials have been prepared by professionals, however they should not replace professional services, and the user should seek advice before acting on any information presented. Every situation is uniquely different, and could make a world of difference on implementation of specific regulations. YR TAX Compliance LLC assumes no obligation to provide notification of changes of tax laws, regulations or other factors that could affect the information posted.