So, you have started a new businesses venture, and wondering what taxes you need to file, to whom and what’s the difference. The U.S. Constitution authorizes U.S government(s) to collect various types of taxes from you. Each form of taxation is governed by separate and distinct bodies of law, and vary depending on where your business is register, under what entity type, what type of goods and services the business provides, and where the business provides these goods or services to their customers.

We will go over the Governing bodies for possible tax compliance requirements, and what kind of taxes could be imposed for the most common small business startup. There are definitely others that could apply; so, don’t take this list as complete.

Federal Taxes – Governed by the Internal Revenue Service (IRS).

General Rules

Federal Income Taxes

Due annually and is one of the most common form of federal taxation is the income tax. The income tax rules allow the government to collect taxes from any person or business that earns money during the year. The tax rules provide a broad and sweeping definition of taxable income to include all property you receive, regardless of whether you earn it at work, through a business or from making good investments. Although this can seem overwhelming, the rules also provide a wide range of credits, deductions and exclusions that reduce the amount of tax you must pay.

For businesses with employees

Federal Employment Taxes (FICA)

Due Quarterly and is applicable to businesses that hire employees. Half is deducted from the employee’s paychecks, and the other half is paid by the employer. These taxes fund Federal Social Security and Medicare.

Federal Unemployment Taxes (FUTA)

Due January 31. However, if you deposited all FUTA tax when due, you have until February 10 to file. Only employers pay for FUTA tax. You must pay FUTA tax if:

- You paid $1,500 or more in wages during any calendar quarter, or

- You had at least one employee for at least part of a day in any 20 or more different weeks.

Some employers are exempt from FUTA tax, even if they meet one of the previously listed requirements. Organizations with 501(c)3 status are exempt from FUTA tax. If your hire your parent, spouse, or child who is less than 21 years old, their wages are exempt from FUTA tax.

State – Governed by the Department of Revenue for the state (DOR-WA).

General Rules

State Income Taxes

Due annually and is most similar to the Federal income tax, is applicable to both businesses and individuals. Most state tax returns start with federal adjusted gross income (AGI), certain states require adjustments to AGI, and New Hampshire and Tennessee tax only interest income and dividends. All other states have either flat or progressive income tax systems. The rates differ from state to state therefore check with your states authority for the rates applicable in your state. There are a few states that do not charge state income taxes : Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming are the lucky few that give this tax brake to the business and individuals in their state.

Gross Receipts tax

Nevada, Ohio, Texas, and Washington forego corporate income taxes but instead impose gross receipts taxes on businesses. The tax is calculated on the GROSS Receipts, but generally the rate is much smaller that that of income taxes. Delaware and Virginia impose gross receipts taxes in addition to a corporate income tax. South Dakota and Wyoming levy neither corporate income nor gross receipts taxes.

Note some businesses may be subject to other taxes, for example sin tax, for businesses selling alcohol, tobacco, tanning, among others. Or, Fuel and Road tax for businesses in the freight industry (Truck Drivers).

For businesses with employees

State Unemployment Taxes (SUTA)

Typically, only employers pay SUTA tax. However, employees in Alaska, New Jersey, and Pennsylvania are subject to state unemployment tax withholding. If you have employees in any of these three states, you will withhold the tax from their wages and remit the tax to the state. Employees will not handle this tax themselves.

States might exempt businesses from paying SUTA tax. For example, a state might exempt nonprofit organizations and businesses with few employees. The exemptions vary by state, so make sure you check your state laws.

SUTA taxes do not have a standard rate. Each state sets its own rates.

Workers Compensation

In all states, businesses hiring employees must pay for state worker’s compensation insurance coverage in the event that an employee is injured or becomes ill due to a workplace illness or injury. Thus, workers are required to be insured under a worker’s compensation policy. A Worker’s Compensation Waiver or Exemption is a form used by some states to allow certain individuals (like independent contractors) to be exempt from worker’s compensation payments.

Local – Governed by the Department of Revenue for the state and County.

Property Tax

Property taxes are typically levied by your state or local government. However, your state establishes the guidelines under which local government can impose property taxes. Each of the 50 states has its own criteria for what property is taxable.

- Some states allow local communities to tax real property. This includes land and items that are permanently attached to the land. Real property includes homes, factories, wharves, and condominiums.

- States can also permit local governments to tax personal property. This consists of property that is movable, such as boats, cars, jewelry, airplanes, computer, equipment, tools, and furniture.

The amount of tax to be paid is figured on the total value of the property or on a certain percentage of the value.

Sales Tax

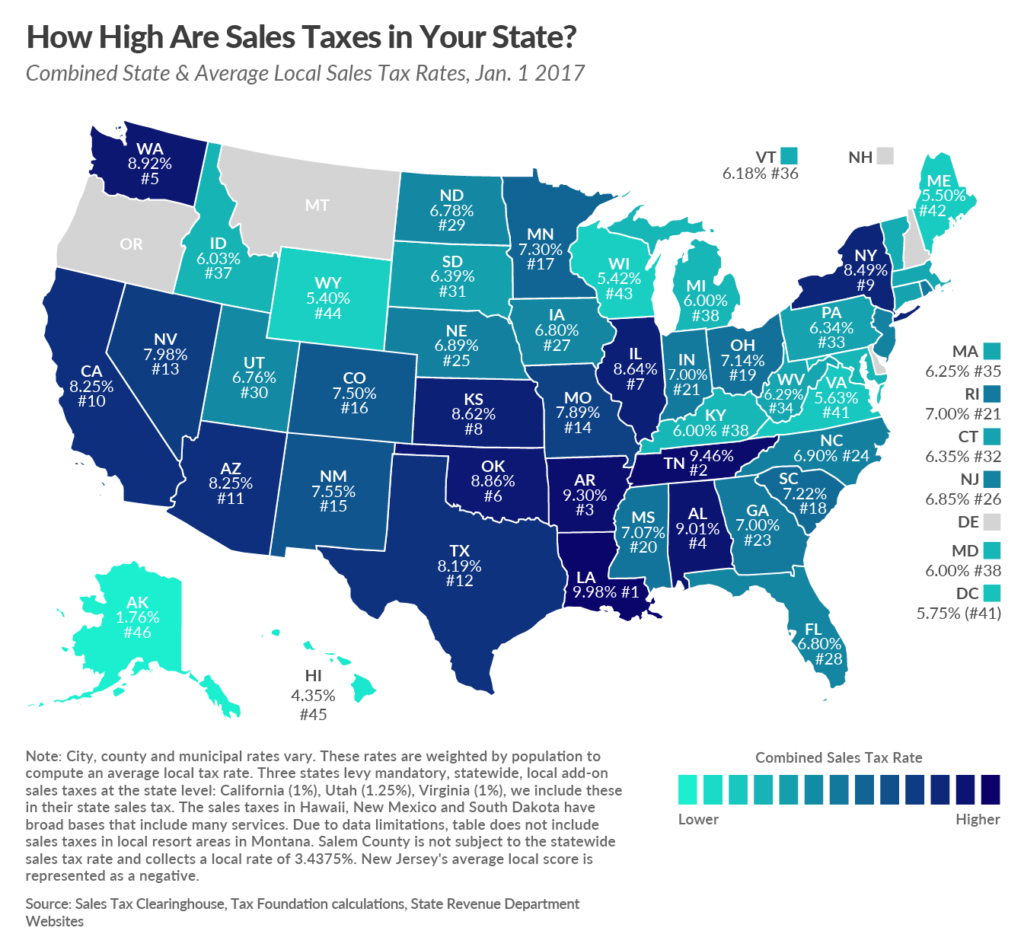

States may impose a tax on the sale of goods and services. Rates may vary by county. Typically you pay/charge sales tax when you purchase goods or services.

Exclusions in sales tax often include food, clothing, medicine, newspapers, and utilities. In addition, certain groups are often exempt from paying sales tax. Charitable, religious, and educational groups are often excused under certain conditions.

Use Tax

Many states also have a use tax. Similar to a sales tax, a use tax is imposed for the storage, use, or purchase of personal property that is not covered by sales tax. Typically this applies to lease and rental transactions or to major items purchased outside of the state, such as automobiles.

For More information on different states Taxes, filling, and due dates see:

Tax classifications for common business activities, DOR-WA

The materials posted in this article are for informational purposes only and should not be regarded as accounting or tax advice provided by YR Tax Compliance LLC. These materials have been prepared by professionals, however they should not replace professional services, and the user should seek advice before acting on any information presented. Every situation is uniquely different, and could make a world of difference on implementation of specific regulations. YR TAX Compliance LLC assumes no obligation to provide notification of changes of tax laws, regulations or other factors that could affect the information posted.