For estimated tax purposes, the year is divided into four payment periods. Each period has a specific payment due date. If you don’t pay enough tax by the due date of each payment period, you may be charged a penalty even if you’re due a refund when you file your income tax return at the end of the year.

If you mail your estimated tax payment and the date of the U.S. postmark is on or before the due date, the IRS will generally consider the payment to be on time. If you use IRS Direct Pay, you can make payments up to 8 p.m. Eastern time on the due date. If you use a credit or a debit card, you can make payments up to midnight on the due date.

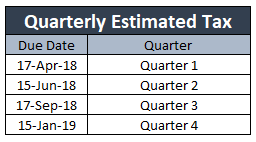

Q1 – April 17, 2018: Not only is this the income tax due date, it’s the due date for your first quarterly estimated tax payment. (Hardly seems fair, does it?) This month, you’ll pay quarterly estimated taxes on the income you made from January 1 – March 31 of 2018.

Q1 – April 17, 2018: Not only is this the income tax due date, it’s the due date for your first quarterly estimated tax payment. (Hardly seems fair, does it?) This month, you’ll pay quarterly estimated taxes on the income you made from January 1 – March 31 of 2018.

You might have noticed that Tax Day falls a little late this year. That’s because April 15, 2018 is a Sunday, and then Monday April 16 is Emancipation Day – a holiday celebrated in Washington D.C.

Q2 – June 15, 2018: This is when you’ll pay quarterly estimated taxes on the income you made from April 1 – May 31 of 2018.

Q3 – September 17, 2018: Quarterly estimated taxes for the months from June 1 – August 31 of 2018 are due on this date.

Q4 – January 15, 2019: Quarterly estimated taxes for the months from September 1 – December 31 of 2018 are due on this date.

Fiscal Year Taxpayers – If your tax year doesn’t begin on January 1, see the special rules for fiscal year taxpayers in Chapter 2 of Publication 505

See IRS Website for more information.

The materials posted in this article are for informational purposes only and should not be regarded as accounting or tax advice provided by YR Tax Compliance LLC. These materials have been prepared by professionals, however they should not replace professional services, and the user should seek advice before acting on any information presented. Every situation is uniquely different, and could make a world of difference on implementation of specific regulations. YR TAX Compliance LLC assumes no obligation to provide notification of changes of tax laws, regulations or other factors that could affect the information posted.