In most cases, a taxpayers federal income tax will be less if they take the larger of their itemized deductions or standard deduction.

Definitions:

Standard deduction

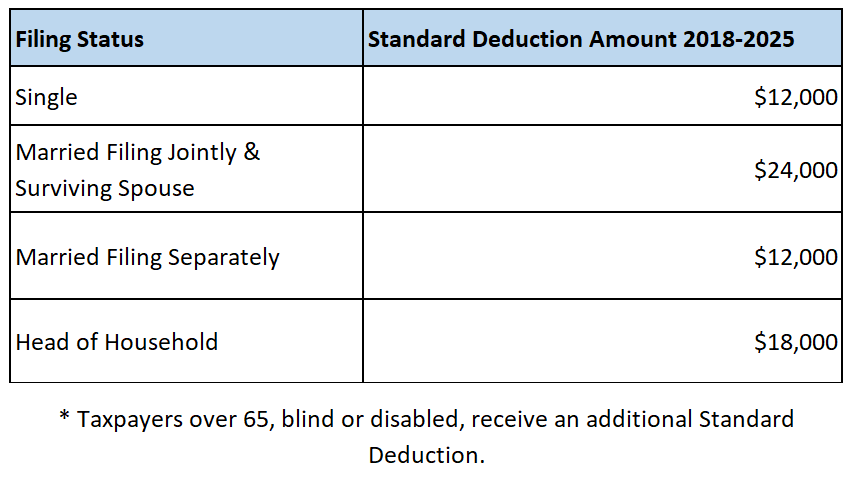

The standard deduction is a dollar amount that reduces the amount of income on which the taxpayer is taxed and varies according to the filing status; there is also an additional standard deduction for individuals who are blind, disabled or age 65 or over.

A taxpayer CANNOT take the standard deduction if they itemize deductions. In addition, certain individuals cannot take a standard deduction or can take only a reduced standard deduction.

Not Eligible for the Standard Deduction

Certain taxpayers aren’t entitled to the standard deduction:

- A married individual filing as married filing separately whose spouse itemizes deductions

- An individual who was a nonresident alien or dual status alien during the year (see below for certain exceptions)

- An individual who files a return for a period of less than 12 months due to a change in his or her annual accounting period

- An estate or trust, common trust fund, or partnership

However, certain individuals who were nonresident aliens or dual status aliens during the year may take the standard deduction in the following cases:

- A nonresident alien who is married to a U.S. citizen or resident alien at the end of the tax year and makes a joint election with his or her spouse to be treated as a U.S. resident for the entire tax year;

- A nonresident alien at the beginning of the tax year who is a U.S. citizen or resident by the end of the tax year, is married to a U.S. citizen or resident at the end of such tax year, and makes a joint election with his or her spouse to be treated as a U.S. resident for the entire tax year; and

- Students and business apprentices who are residents of India and are eligible for benefits under paragraph 2 of Article 21 (Payments Received by Students and Apprentices) of the United States-India Income Tax Treaty

Refer to Publication 519, U.S. Tax Guide for Aliens, for more information.

Itemized Deductions

If a taxpayer itemizes, they can deduct a part of their medical and dental expenses and amounts they paid for certain taxes, home indebtedness interest, charitable contributions. You can also deduct certain casualty and theft losses. Using Schedule A (Form 1040) to figure their itemized deductions.

If taxpayers and their spouse paid expenses jointly and are filing separate returns for 2018, see Pub. 504 to figure the portion of joint expenses that they can claim as itemized deductions.

Note: Don’t include on Schedule A items deducted elsewhere, such as on Form 1040 or Schedule C, C-EZ, E, or F.

Each of the allowable Schedule A deductions have their own rules to be considered qualified, have records available, limits that they cannot exceed, and and amounts(floors) that they need to exceed to be deductible(allowable). In most cases, taxpayers federal income tax will be less if they take the larger of their itemized deductions or their standard deduction.

If you have questions about certain expenses and their eligibility to be deducted as an itemized deduction, feel free to contact me. I would be more than happy to answer any questions.

For more information on how Itemized deductions have changed due to the Tax Reform see: Itemized Deductions Post Tax Reform

The materials posted in this article are for informational purposes only and should not be regarded as accounting or tax advice provided by YR Tax Compliance LLC. These materials have been prepared by professionals, however they should not replace professional services, and the user should seek advice before acting on any information presented. Every situation is uniquely different, and could make a world of difference on implementation of specific regulations. YR TAX Compliance LLC assumes no obligation to provide notification of changes of tax laws, regulations or other factors that could affect the information posted.