With Standard Deductions doubling after the Tax Reform it became harder to benefit from the Itemized Deductions. For, Itemized Deductions only start to benefit the taxpayers tax return when they exceed the Standard Deduction. Under the previous law that threshold was $6,500 for single filers and $12,000 for married filing joint filers. After the Tax Reform those amounts increased to $12,000 for single filers and $24,000 for married filing joint filers.

While this change will reduce the number of taxpayers benefiting and therefore claiming Itemized Deductions, it will not eliminate them altogether.

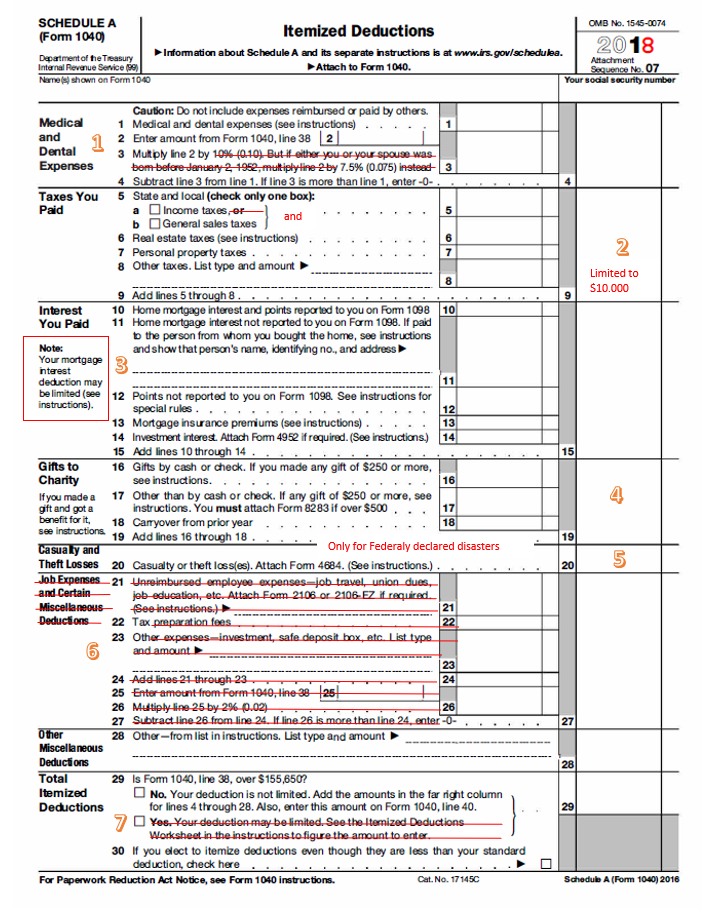

Bellow is a summary of changes to the Itemized deductions due to the Tax Reform through 2025

1. Medical Deductions

Affecting 2017-2018 tax years. Tax Reform reduced the 10% Adjusted Gross Income (AGI) threshold to 7.5% for regular and AMT tax: therefore, increasing the deduction allowed.

2. State and Local Taxes Deductions

A new limit is set of $10,000 on deduction for state and local taxes including property and income or sales taxes. This limit is reduced to $5,000 if the taxpayer files under married filing separate status.

3. Home Mortgage Interest Deduction

Interest deduction on the taxpayer’s home mortgage was reduced from indebtedness limit of $1Mill to $750,000.

Or, $350,000 for taxpayers filing under married filing separate status.

Also, in most cases eliminating the deduction for interest on home equity debt. With the exception that the debt is used to buy, build or substantially improve the taxpayer’s home that secures the loan.

4. Charitable contribution Deduction

Allowable charitable contribution deduction was increased from 50% of AGI to 60% of AGI limit. And, taxpayers are no longer entitled to deduct payments made to a college or college athletic department in exchange for college athletic event ticket or seating rights at a stadium.

5. Casualty and Theft Losses Deduction

Casualty and theft losses are eliminated with the exception for federally declared disasters.

6. Miscellaneous Itemized Deductions

Miscellaneous Itemized Deductions subject to the 2% floor, were eliminated completely.

Examples of deductions eliminated:

Certain Investment expenses

Professional fees (including tax return preparation fees)

Unreimbursed EMPLOYEE business expenses – this includes expenses a taxpayer incurs in their job that are not reimbursed, like supplies and tools, required uniforms, dues and subscriptions including union dues, and job research expenses. Also, no longer allowed unreimbursed travel, meals, mileage, as well as the home office deduction.

Do NOTE that this affects only employee expenses related to their job, not business owners. Business owners report their expenses on Sch. C. therefore are unaffected by the changes to the Sch. A. and are still allowed to deduct all of their ordinary and necessary business expenses, even if mentioned above.

7. AGI based limit

Elimination of the AGI-based reduction for certain itemized deductions.

For more information see:

Interest On Home Equity Loans Deduction

The materials posted in this article are for informational purposes only and should not be regarded as accounting or tax advice provided by YR Tax Compliance LLC. These materials have been prepared by professionals, however they should not replace professional services, and the user should seek advice before acting on any information presented. Every situation is uniquely different, and could make a world of difference on implementation of specific regulations. YR TAX Compliance LLC assumes no obligation to provide notification of changes of tax laws, regulations or other factors that could affect the information posted.